In this post we take a look at:

Primer on UMA - what is it, how it works

Benefits to token holders, token sponsors, and $UMA holders

Discounted cash flow valuation of the protocol under various scenarios.

What does UMA do?

UMA makes “minting and collateralizing” ERC20 tokens safe and easy.

It allows people to mint new ERC20 tokens with collateral behind them.

Collateral can be safely liquidated by token-holders.

Liquidation values can be linked to S&P 500 price, Gold Price, BTC hash rate, or any other “human verifiable” feed, thus creating “synthetic trackers”.

In case of collateral-liquidation disputes, UMA provides a decentralized Human Oracle platform (the DVM) to settle contracts.

What is a synthetic token?

For example, if Gold is trading at 1800 USD, and you get 1 gold synthetic token, you should be able to liquidate at least 1800 USD worth of value from collateral behind it. That’s the basic premise of a synthetic token.

To guarantee you will be able to exercise this right, synthetic token sponsors (producers) must keep overcollateralized positions behind the tokens, and risk losing all collateral if they don’t meet this over-coverage commitment.

Since collateral covering more than the entire price is behind these tokens, they are traded in the market for the same value as if it was real gold.

Example gold synth:

In the specific case of Gold at 1800 USD, I could have a 2500 DAI locked in the contract per every one gold ERC20 token in circulation. That being verifiable on-chain, the Gold token could be traded at 1800 DAI price in the market.

Examples of possible synthetic tokens

Gold ERC20,

Oil ERC20,

KWh_USD ERC20,

Jamaica_gold_medals in the Olympics ERC20,

Tesla Stock ERC20,

Effective 12month Fed Interest rate ERC20,

10yr Treasury yield ERC20.

There’s no limit to what you can imagine minting and collateralizing.

Existing synths

All Dai and Synthetix sTokens in circulation have one thing in common: They’re all collateralized synths.

For the first time, UMA democratizes the ability for anyone to “mint and collateralize” their own synths. And it allows synth sponsors to do “easily”, without having to write all the collateral management logic from scratch and using a trusted oracle and efficient price oracle system.

Architecture

You can think of it as two large components:

A customizable synth writer: this can mint new ERC20s, locking in collateral. UMA calls this “token factory”.

A distributed human oracle system (DVM). The DVM orchestrates humans voting on price feeds, to enable collateral withdrawal from the minted ERC20s in case of disputes.

Oracle system

UMA uses clever game theory to minimize the number of times participants call the Oracle, saving both fees and time. This is how it works:

Undisputed liquidations: When collateral liquidations are done without issues, and both parties are happy with the pricing of collateral, no Oracle is required.

Disputed liquidations: If the sponsor disagrees with liquidation, they’re able to freeze collateral release, and invoke UMA’s DVM oracle to vote on a price and settle the liquidation neutrally.

Both parties benefit from collateral being in escrow while the token is circulating. Both parties benefit from UMA acting as an independent third party in case of dispute

Synth Example: Light Crude Oil

Say you wanted Synthetix to have a synth with the price of Light Crude Oil, an sLCO, and imagine that wasn’t available. You could now build your own:

You get UMA holders to approve adding an LCO price feed in the system.

You parameterize a token factory with collateralization rates, etc

You stake your collateral, and then use UMA to mint erc20 tokens, with collateral redemption linked to LCO price feed.

You now have your own collateralized DeFi token ready to trade in the market.

As a sponsor, you can pre-mint a batch of ERC20 collateralized tokens, and set up as an LP on an AMM with your new token, and receive fees from users buying it from the pool.

It’s key to appreciate that to launch such a token, you wouldn’t have to come up with all the collateralization and oracling logic yourself; you could simply parameterize a factory/minter, stake the collateral, and rely on UMA contracts for the management of collateral during liquidation, settlement and pricing.

(Today sponsors would also have to come up with “keepers” to monitor inappropriate liquidations, although in the future there may exist generic players doing this for all sponsors).

Benefits

For token minters (sponsors):

Able to open new token markets with safe collateral custody.

Higher speed to market, by using ready-made UMA settlement logic

Higher customer trust, by using battle-tested UMA on-chain settlement and oracling logic

For token holders:

Exposure to new risk markets (Oil, Gas, Electricity, Bets, Commodities, Indices, etc), backed by on-chain verifiable collateral

More trust. Safe settlement guarantees, based on battle-tested UMA settlement logic

24/7 trading, high liquidity, fungibility, and all ERC20 general benefits.

For $UMA participants:

Potential to be the underlying platform for a large chunk of all synthetic tokens minted and collateralized in DeFi world-wide.

UMA holders economically benefit from increasing amounts of collateral custodied in the platform

It is hard to imagine all that can be built on top of this new DeFi lego. No limit to all things one could want to collateralize and trade on.

Economics and opportunity

The “synth” market in Fiat is over 500T in size. If all of this financial engineering was ported to the ethereum distributed machine, the opportunity would be gigantic. UMA could become the platform in which millions of ERC20 tokens are collateralized.

What are the economics of this system?

Two sources of earnings:

Token sponsors pay on-going fees when locking collateral in UMA tokens.

Disputed liquidations carry fees for human price verification.

In other words, earnings produced by the protocol scale with the amount of collateral stored in it, and the amount of human intervention required.

Scenarios considered:

The UMA team works under the central premise that low human intervention should be necessary, for game-theoretical reasons.

On that basis, we concentrate on two key parameters to build outcome scenarios:

Fee rate charged for locking collateral into synths

Total amount of collateral locked in

RESULTS

This is the matrix of the present value of earning flows for the protocol at 0% discount rate, for a range of scenarios produced by mixing:

Collateral ceiling: the natural collateral maximum the protocol will achieve

Year: by what year is that maximum reached

0% Disc rate / 1% collateral fee / 1% dispute rate / 3% penalty fee

The matrix shows valuation behavior across many scenarios at once.

For clarity, the 500B ceiling by 2030 cell, computes these earnings flows:

Notice how in the 0% discount scenario, present value is full value.

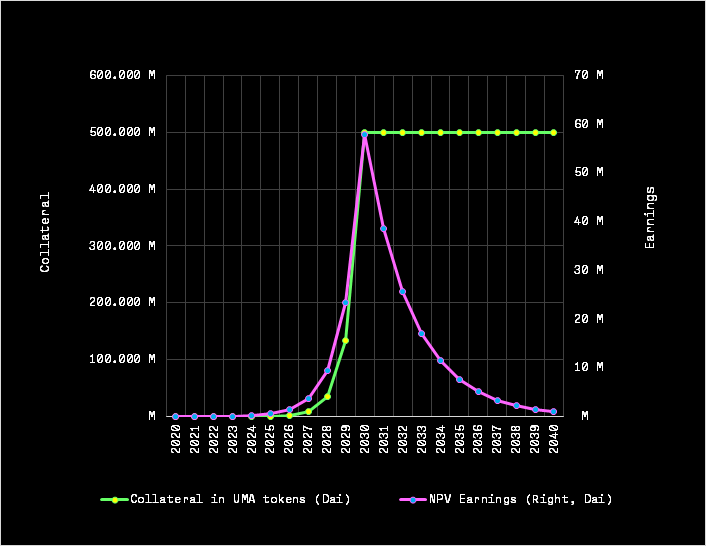

Same info graphically: 500B ceiling by 2030: This is how the model assumes collateral growth & ceiling during the simulations.

@ 0% Disc Rate

Our collateral growth model is exponential, and flat once the ceiling is reached. We think it would make sense for adoption to be exponential as a best-case scenario.

As you can see, earnings and collateral scale in tandem.

HIGH RATES SCENARIOs

Let’s now look at how the matrix looks, if we raise store fees to 5% and dispute rates to 5%.

Results are about 6X better, but the break-even still happens at about 500M to 1T in collateral.

50% DISCOUNT RATE

Let’s look at both these scenarios, but now at 50% disc rate, to discount uncertainty by 50% every year we travel into the future in each scenario.

Here’s an example of the same 500B by 2030 example: 211M Valuation

Same scenario graphically:

@50% disc rate

Notice how Earnings grow until 60M, two orders of magnitude less than at 0% disc rate. After reaching the collateral ceiling, DR continues growing at 50% but collateral is flat. Thus the “wave” shape of the present value of earnings.

HIGH DISCOUNT RATE & HIGH RATE

Same idea. Raising fees, disputes, or penalties, helps increase the earnings, but break-even remains largely in the same magnitudes. With 50% Disc rate, only more than 50%+ per year collateral growth survives valuations.

Conclusions

It is down to each person to make their own judgment as to what amount of collateral may eventually be locked in UMA contracts, and how fast it will get there.

What’s clear either way, is that for the protocol to justify valuations of $100M+, the roadmap somehow should include a clear path towards collateralizations in the range of tens of Billions or more.

This seems to be a theme for many DeFi protocols. In our previous analysis of Maker, a similar conclusion was reached. Current market valuations suggest investors are “implicitly pricing in” these protocols will reach billions+ in collateral.

Final thoughts

In our opinion, the market will eventually “weigh” these protocols properly, and find their price. More importantly perhaps, is to consider UMA as an example of an emerging new class of business. The DeFi business. A new category of economic engine, that creates transparent win-win scenarios for its users, generates earnings and is governed by skin in the game DAOs.

We can learn much by looking at how these impressive teams build their communities, make design choices, get financed, and operate in the real world to bring to life these new types of economic engines.

It is fascinating to see this whole industry unfold and to think of all that could be built in the coming decades.

Maximum respect and gratitude to Allison Lu for being available for comments, and to the whole UMA team for the incredible protocol they’re building. It’s an inspiration for the entire eco-system, and potentially a key building block in a nascent industry that could become huge.

We write this for the benefit of everyone interested in learning about DeFi, and because we think these are genuinely interesting topics and help the community think in economic ways that we find exciting ourselves.

We don’t have any premium tiers - subscription is free for all! Subscribe now to get new articles.

You can also follow us on twitter at https://twitter.com/CryptoEsp

What does this say about UMA's current valuation at 1 Billion $? Extremely overvalued ? :)