MakerDAO fundamental analysis

What growth rates are implicit in the current $350M Maker valuation?

MakerDAO can be thought of as a decentralized business with customers, owners, and profits.

In this post, we will run a fundamental analysis on this decentralized business based on discounted earning flows, and compare results with its current market cap of approximately $350M.

The bottom line is that the current valuation implies very aggressive growth rates, of over 70%+ Dai circulation increase per year reaching Trilions of Dai in circulation, in order for current valuation to make sense.

Significant collateralization changes will be required if Maker is to be able accomplish these circulation goals.

MakerDAO’s business model

Maker offers two basic services: lending and saving.

Lending: Maker’s users, lock colateral into smart contract, and are able to take out a loan from it. When the loan is returned + interests, users can unlock the colateral. The interests paid are called Stability Fee, or SF.

Saving: Users to lock money into a separate set of smart contracts, and earn saving interests from them. The interests earned are accrued at so called Dai Savings Rate, or DSR.

Typically there is a spread between the SF and the DSR. Recently for example, SF was at 0,5% and DSR at 0%. This spread between interests earned and interests paid can be thought of as the “operating profits” Maker collects.

These profits can used to re-capitalize the system if things go bad. When everything is going well however, funds in this bucket are expected to be used to reward MKR holders. MKR holders are rewarded in return for their efforts governing the system.

Scenario Example

Let’s take a look at a simple 20 year scenario between now and 2040.

Let’s imagine the system requires no recapitalization at all during this period, and that all profits collected from interest spread are kept in the business.

We will make the following assumptions:

Interest Spread: Kept constant at 0,5% during next 20 years.

Dai in circulation: Grow at a constant 60% per year, during the next 20 years.

The total profits in this very simple projection are 16B Dai. These profits over 20 years can brought back into present time, by applying a discount rate.

Assuming every year you go into the future increases uncertainty by 50% (discount rate), the risk adjusted present value of the future profits becomes 14.3M DAI.

In start-up valuations, VCs typically employ discount rates from 30% to 70%, so this feels like a reasonable rate for a DeFi project.

Generalizing projections

Let’s now look at how the profit projections change, changing two key variables: The future annual growth of Dai in circulation, and the future spread earned on it.

Note how the example we saw was 14.3M DAI in the 60% circulation growth, at 0,5% spread (highlighted). For lower colateral growth rates, profits descend rapidly. For higher spreads, or higher circulation growth, the opposite.

Comparing to current market cap

We reached the critical part of the post. Let’s see how the scenarios we computed compare to Maker’s current valuation.

One key idea in fundamental analysis, is that the value of an investment makes sense if its price is lower than the sum of future discounted cashflows. Current Maker’s total price is its market cap of $350M.

Maker will be cheap if the sum of discounted profits exceeds 350M, and it’ll be expensive if discounted profits are lower than that. This is what the following chart shows:

This shows the combinations of circulation growth and Interest spread for which the current 350M valuation is cheap (green) or expensive (pink).

One way to look at this, is to say that the current market valuation has built-in certain implicit growth and spread combinations: People buying MKR should expect to be in the green zone, and therefore are implicitly betting for these circulation growths.

The past table is at 50% discount rate. Let’s see how the price changes at different disc. rates:

This gives us an idea of what are the Dai circulation growths required for the current pricing to be attractive. As you can see, even at 30% disc rates, for low spreads, the current valuation implies a 70%+ growth in circulation annually for the next 20 years.

Dai circulation scenarios

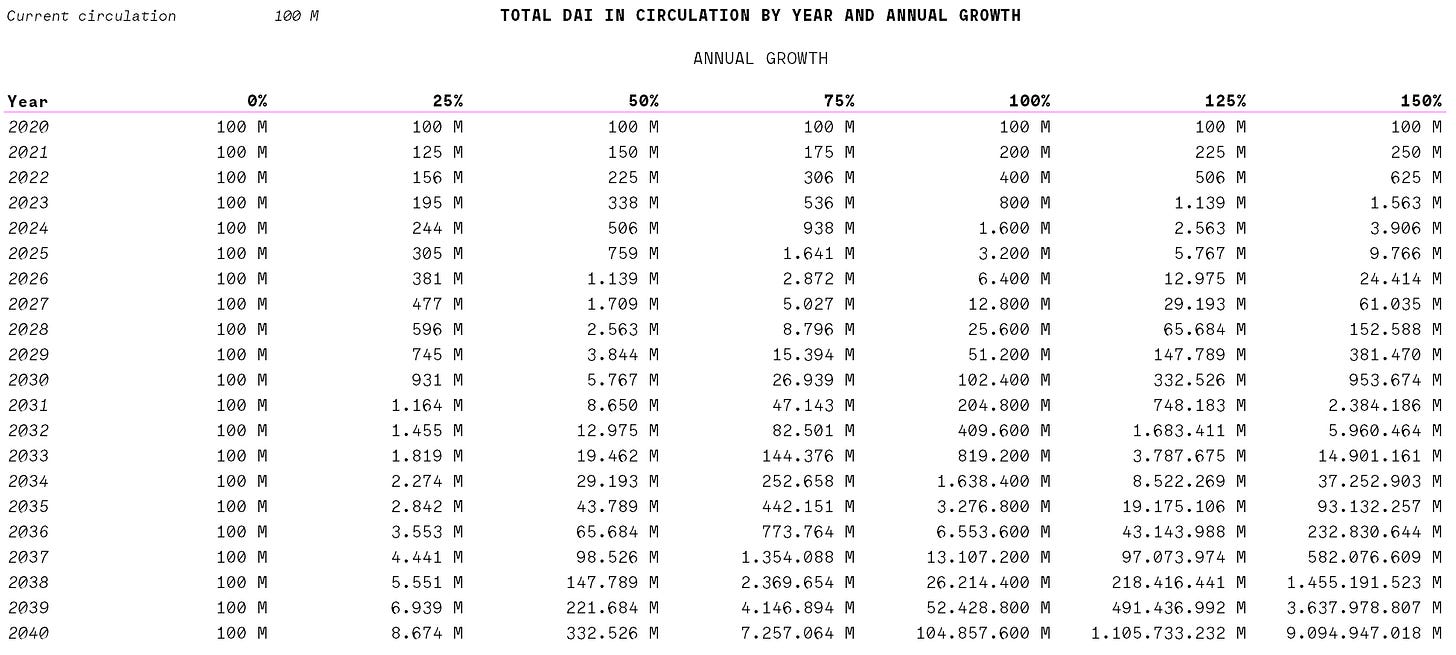

Let’s look at what these DAI annual circulation growth rates mean in absolute numbers:

In other words, for Maker’s capitalization of $350M to be a good deal Dai circulation by 2040 should be in the trillions.

Considering Ethereum’s total current market cap is $23B, some pretty big things need to change at a structural level, if Maker/Dai are to be able to support these growth levels.

Bad debt and liquidation rate

After discussing these results with some the maker community (thanks again!), we decided to add two additional variables to check results: Bad debt, and Liquidation rate. Definitions:

Bad debt: % of DAI that require re-collateralization through debt auctions. They eat from earnings.

Liquidation Rate: % of CDP/Vaults that get liquidated, generating 13% liquidation fees. The help earnings.

In 2019 observed Liquidation Rate was 20%.

1% bad debt + 20% Liquidation rate:

Slightly better results, but still requiring high CAGRs to break even.

Now the same, with 5% bad debt:

Important result. We can see that if Bad debt is 5%, at some interest spreads, there’s no amount of DAI circulation that makes the current valuation a winning one.

Bad debt can’t be >> than Interest spread.

At the moment spread is 0%, and Bad Debt is over 5% :(

Final results

We will combine everything together and look at a returns heatmap from the perspective of a MKR holder.

Charts shows: if DAI supply reaches X, by year Y, what’s the compound annual growth (CAGR) of an investment in MKR, considering I bought at $350M valuation? Earnings are risk adjusted with a 50% disc rate.

First scenario: High bad debt.

We see for a MKR holder, high bad debt to spread is the worst enemy.

Viable scenarios: Healthy, even massive returns are possible for MKR holders if the right parameters and growth take place:

In this tweet post you can see more combinations of spread/LR/ bad debt.

The bottom line is clear: Bad debt and spread can’t be too far apart, and you need trilions of supply by 2040.

Possible supply drivers

It’s now clear that DAI in circulation is a key factor as an MKR holder. At 100M circulation there’s massive work ahead before it reaches hundreds of billions. Considering Ethereum’s total market cap is $23B, to think about 10T of DAI circulation is daunting. Clearly a new approach to colateral is needed. How could it ever get there?

One option could be the arrival of real-estate as accepted collateral in Maker. If that was to happen, then I think 1T+ DAI would a possibility. There are over $170T worth of real estate in the world today, and so this should be mechanically feasable.

A different route, might come from a concept being discussed in Maker forums, concerning the break of the peg, and the possibility of undercolateralization. You can read the detail here. If this was to pass, it would be a massive boost to DAI supply, and would facilitate much faster supply growth.

Conclusions

For Maker to generate profits that justify a market cap of $350M, a key barrier to break is the amount of DAI in circulation. Under optimistic assumptions, figures show that growth in circulation needs to be over 70%+ per year, reaching hundreds of billions to trillions by 2040.

Demand for Dai has clearly been there so far. So much so, that it’s been difficult to keep the peg close to $1. The big challenge remains to be the increase in supply in a structural way that allows to reach hundreds of billions of Dai in circulation over the next decades.

One additional challenge for MKR holders are the current low spreads. Maker governors need to think about how to bring spreads back into a healthy margin, coherent with bad-debt levels, without hurting supply levels. Very tricky indeed!

MakerDAO is a very important project for DeFi - not only is it a critical Lego piece, it also is a model for how DeFi DAO-based orgs can operate. We’re all going to learn much from how this will all unfold.

Analysis limitations:

The analysis could be made a lot more complex with non-static spreads and rates, but I hope it is still helpful in showing the impact of key operating parameters, and how they relate to the current $350M current valuation, in broad strokes.

All comments / thoughts welcome.

Thank you for the comments and helpfulness from members in the Maker community: doopson, Maker_Man, ElPro, @tomhschmidt.