Back-testing details - why does the system diverge?

A closer look at the back-testing engine and its results.

System testing

This is the process applied:

I buy protection on 1 ETH. With left-overs after purchase, I buy ETH.

At expiration: if contract has intrinsic value, I collect it, and buy ETH with all proceeds.

Day after expiration: Open new put contracts for the new total amount of ETH held. I pay for it with my own ETH held.

Repeat 2 and 3 at every expiration.I’m very interested if anyone has feedback on the testing systyem. To me it’s important that the correct figures are shown:

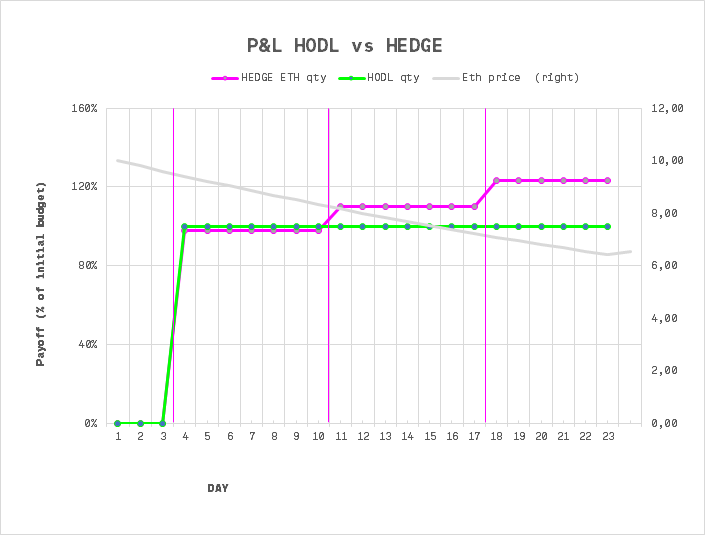

Let’s look at the system over a short time period.

Flat pricing scenario

P&L defined as: (value of current position / value at start of investment) -1 .

As expected, hedging underperforms by 2% a week.

Increasing price:

If prices increase continuously, HODL outperforms hedging.

Decreasing price:

In this example where price went down for three weeks straight, hedging only loses the fees weekly. Crucially, during this period, it’s buying ETH all the while.

Let’s look at same graph, but qty held, instead of USD value.

As you can see, as prices go down, not only am I keeping my P&L flat-ish, I am also increasing my ETH holdings!

Extreme example

Let’s illustrate a 70% drop in a week:

Price starts at 10, drops to 3, goes back up to 10:

This is a key observation: Price went 10 to 3, then 3 to 10. At the end of the process, hodling is flat 0% in (still at 10), whereas the P&L for hedging is at 215%!!! UP.

Why?

At expiry, I collected $7 in intrinsic value (the loss in value), and used these $7 to buy ETH, when ETH was specially cheap ($3). So I get 2,33 eth for my $7. Those are in addition to the 0,98 I was holding, for a total 3.2 ETH. All the while, I have only 1 ETH when I hold.

When prices goes back from 3 to 10, hodling gets a 3.3X boost on 1 ETH, and goes back to $10 holdings, P&L=0%. I started with $10, I still have $10.

Hedging gets the same 3.3X boost but on 3.2ETH position, so ends up at 32$ holdings. P&L=215% gain on my $10 initial investment.

Main idea

The reason I highlight this is because this is a key pattern: when price comes back up after a down turn, hedging absolutely outstrips hodling because of the higher amount of ETH held.

You have leveraged gains on the way up. You have 2% cost on the way down. And the system is going up and down all the time. The more volatile it is, the more it creates unbalance in favor of hedging.

When the strategy re-loads weekly instead of monthly, the results are even more exaggerated. In this particular run from August 2015 to April 2020, Hedging ended up holding 1200 ETH, vs 1 ETH in the HODL strategy. Also please note that during black-thursday, which saw a 50% decrease, it literally doubled its ETH exposure, in a single cycle.

Why? Again, price drops 50%, I collect 50% in intrinsic value, I buy ETH with it, which is at 50% price, and so I double my stake in a single step.

If the system is indeed exponential, then the higher the refresh cycle, the more chances of catching drops, and load up on ETH faster.

Questions/Research:

>Ideas for errors/bugs in the buying/mechanic of the model engine?

>Is there any DeFi tool that allows you to implement a simple strategy like the one presented here, in a hands-off way? ie. I post ETH to an address, and then the smart-contract buys options from Hegic as per strategy heuristic. Want to work on one? DM.

>Could an AMM be built, that was bonded to a curve, that created an option price to one party, and yield for the other, and find a price in the market? Like uniswap intrinsically producing prices by the size and direction of the orders from its users.